Greening economy while achieving inclusive growth

Promoting the green transition could be the most important industrial policy in the decades to come, and finance has a role to play in addressing the inclusivity challenges

Efforts to combat climate change and the push for the green transition are, in essence, correcting for the negative externality of carbon emissions resulting from economic activities. To this end, major economies have set timetables for reaching the peak of carbon emissions as well as achieving carbon neutrality.

Greenhouse gas emissions are global in nature, and reducing carbon emissions requires both technological innovations and the restructuring of traditional industries, potentially necessitating an important set of industrial policies in the decades to come. Industrial policies to facilitate the green transition may lead to significant interregional, interindustry and inter temporal utility shifts, resulting in greater income inequalities among different regions and groups of people.

Within an economy, the green transition may lead to inequalities among different regions and economic sectors. Central to the green transition is how to lower the green premium — the additional cost incurred by choosing clean energy over one that emits more greenhouse gases. With the green transition accelerating, traditional industries related to fossil fuels will face rising costs and dwindling production, whereas industries using cleaner energy, buoyed by favorable policies, will gain a comparative advantage. This is likely to increase the income gaps among different regions.

A recent study conducted by the Global Institute of China International Capital Corp shows that the gaps in per capita GDP have been growing between underdeveloped regions with high carbon emissions and those with low emissions, since the adoption of China's policy of "dual control" for energy consumption and energy intensity. As energy-intensive industries tend to lie in the middle of industry chains, they enjoy weaker bargaining power compared with upstream energy producers as well as downstream energy consumers, and they bear the bulk of the transition costs. Since the economies of less-developed regions tend to be more reliant on high-emission industries, the caps on carbon emissions will exacerbate regional imbalances in development.

Carbon reduction will also impact local governments' fiscal revenue. For example, around 40 percent of the fiscal revenues of Shanxi province and the Inner Mongolia autonomous region come from mining and the power industries, they also employ the bulk of local labor. The two regions are expected to face greater fiscal pressure besides the need to provide job training for laid-off workers during the transition process.

So, what role could finance play in facilitating a more inclusive green transition in China?

China can step up the use of policy-based finance, developing transition financing alongside green finance. Policy-based finance has played a vital role in China, as it mobilizes social financing, simultaneously supporting the implementation of national strategies, and funding key areas and weaker parts of the national economy.

In recent years, policy-based finance has made significant contributions in areas that promote equality and inclusive growth, such as work related to agriculture, rural development, the growth of small and micro enterprises, and shanty town renovation. Policy-based financing tools have also promoted green and low-carbon development, building an increasingly comprehensive green financial system.

However, one drawback of the existing green finance system is that it mainly targets new carbon emissions, with limited coverage of the existing carbon footprint of traditional high-emission industries. In comparison, "transition finance," financing provided to high-emission industries, could complement green finance and help fill the funding gap during the green transition, thus ensuring a fair transition for the whole economy.

The Framework for Transition Finance adopted at the recent G20 Summit in Bali, Indonesia, stresses that a fair transition is one of the five pillars of transition finance. The document states that governments and financial institutions of member countries should encourage borrowers to assess the potential socioeconomic implications during the green transition and disclose the measures taken to mitigate possible negative impacts.

In general, China's transition finance lags far behind green finance both in the scale of financing and in the diversity of products. Currently, not enough attention has been paid to ensuring an inclusive green transition, and the potential for growth in transition financing remains substantial. Since 2020, China's financial institutions have rolled out, on a trial basis, standards for the issuing of transition financial products and released trial guidelines in the green finance pilot zone in Huzhou, Zhejiang province.

Last year, the Bank of China and the China Construction Bank published guidelines on transition bonds, which provided definitions for transition bonds and the range of supported use of proceeds. The two banks also issued transition bonds. The National Association of Financial Market Institutional Investors (NAFMII) also launched Sustainability-Linked Bonds (SLBs). By linking the financing costs to an issuer's sustainable performance targets, SLBs help issuers achieve and follow through on their green transition commitments.

This year, the Shanghai Stock Exchange and the NAFMII released a document related to transition bonds. The Shanghai Stock Exchange stressed that funds raised for the purpose of the green transition should conform to the requirements of the national strategic plans and industrial policies, and at least 70 percent of the total proceeds must be used for the green transition. NAFMII requires funds raised by transition bonds to be used exclusively on green transition.

Meanwhile, China can also create a sound financial environment for an inclusive green transition by strengthening coordination between policy-based financing and fiscal policies.

On the one hand, the country should use transfer payments to cushion the impacts on the people affected by the transition and support socioeconomic development in provinces whose fiscal pressure will increase in the process of the green transition. At the same time, support should be given to these provinces to assist in their green transition, for example, by enhancing research on decarbonization technologies. By phasing out the excess production capacity of emission-intensive industries such as steel and coal, China has set up special funds to reward and subsidize the restructuring of industrial enterprises with an emphasis on helping laid-off workers seek reemployment.

In the future, with the progress in transition finance, the country could improve the social security system to smooth household income streams for unemployed persons and create jobs through infrastructure-building projects, which require relatively low-skilled labor and can be rapidly implemented. In addition, social security funds and industrial development funds should be set up to support infrastructure building, ecological restoration, and fostering of new industries to avoid the effects of population migration and the hollowing-out of industries.

On the other hand, as China's national carbon trading market matures, carbon credits could be auctioned, and its revenues could be used to support an inclusive green transition. For instance, the 2022 revision of the European Union's Emissions Trading System proposed to increase the Modernization Fund to help 10 low-income member states modernize their energy systems and improve energy efficiency, which will be conducive to promoting inclusive green energy transition among low-income countries.

Currently, the draft regulations on carbon emissions trading have yet to be finalized. But the revised draft in March 2021 proposed to allocate carbon emission allowances to key emitters for a price, the revenues from which could go into the national carbon trading fund.

In the transition process, China could learn from the practices of the European Union, and consider setting up two funds, one to finance the building of the national carbon market and major programs that reduce greenhouse gas emissions, and the other, dedicated to promoting an inclusive green transition and to support the development of clean energy systems in most vulnerable regions in the process of decarbonization.

The author is chief economist at China International Capital Corp and the executive director of CICC Global Institute. The author contributed this article to China Watch, a think tank powered by China Daily. The views do not necessarily reflect those of China Daily.

Contact the editor at editor@chinawatch.cn

Ningbo seabird project seeks international volunteers

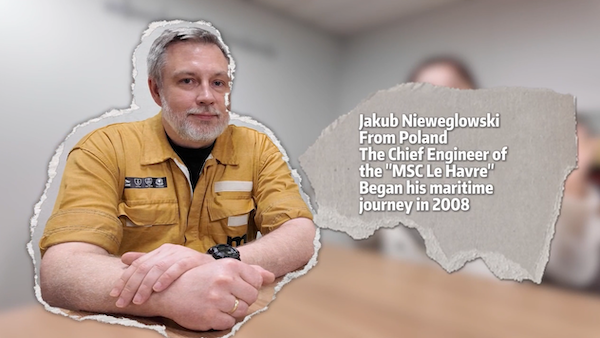

Ningbo seabird project seeks international volunteers  Jakub's journey: From shipyard to sea

Jakub's journey: From shipyard to sea  Badminton Asia COO applauds Ningbo

Badminton Asia COO applauds Ningbo