Time for policy boost to restore realty health

An employee (left) from a real estate sales department introduces a residential project to a potential homebuyer in Taiyuan, Shanxi province, on May 12. WEI LIANG/CHINA NEWS SERVICE

Experts urge cautious approach to avoid sudden overheating, abrupt downturn

With the rise in China's new home prices slowing and investment in property contracting, industry experts have issued calls for stronger supportive measures to restore real estate to healthy development.

As one of the nation's pillar industries, real estate accounts for about 7 percent of the nation's GDP and about 60 percent of urban households' assets, according to the Office of Central Committee for Financial and Economic Affairs.

The industry's performance is closely associated with the nation's overall economic recovery. With that as the backdrop, two views have formed of late. Some people have underlined immediate bailout measures; while others worry that extravagant policies might cause the housing market to overheat in some cities.

Lou Jiwei, former finance minister, said he believes supportive measures are urgently needed. He suggested restrictions on home purchases and home loans should be scrapped, and caps on housing prices lifted, ensuring a soft landing for the country's property market.

Lou also called for plans to levy property tax in due course, with a clear threshold of tax exemption based on the property area owned by a household.

China's property market saw new home prices in major Chinese cities either stay flat or decline in June, while pre-owned home prices fell month-on-month, according to the latest data from the National Bureau of Statistics.

NBS data also showed China's investment in property development fell nearly 8 percent year-on-year to 5.86 trillion yuan ($816.5 billion) in the first half of this year. The residential segment accounted for 4.44 trillion yuan of it, down more than 7 percent year-on-year.

"As various measures took effect, nationwide home transaction volume started to stabilize with firstand second-tier cities taking the lead in recovery," said Sheng Xiuxiu, research director for the residential sector at JLL China, a real estate consultancy.

However, with major indicators of the housing market, including residential investment and new construction, still in a downtrend, property developers should be wary of revitalizing stock assets and cautious about opening new projects, Sheng said.

A slew of measures were launched in the first half. In early January, the People's Bank of China, the country's central bank, and the former China Banking and Insurance Regulatory Commission, then the industry regulator, jointly announced that cities where new home prices dropped both month-on-month and year-on-year for three months, can decide if they would like to retain, reduce or remove lower limits for interest rates on first-home loans in phases.

Ningbo seabird project seeks international volunteers

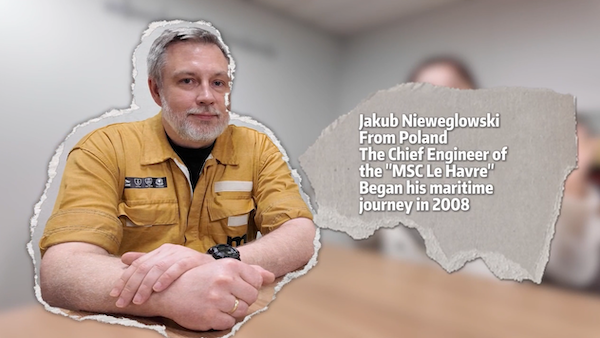

Ningbo seabird project seeks international volunteers  Jakub's journey: From shipyard to sea

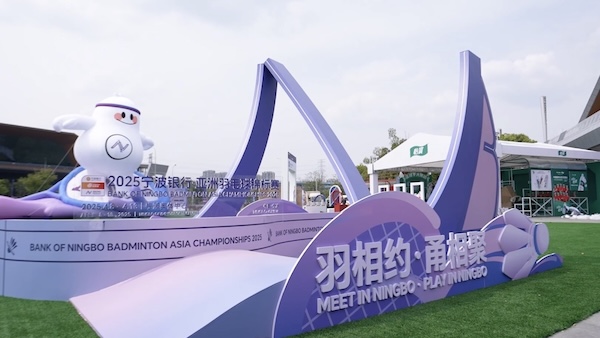

Jakub's journey: From shipyard to sea  Badminton Asia COO applauds Ningbo

Badminton Asia COO applauds Ningbo