Alibaba eyes windfall gains from HK move

Tech heavyweight Alibaba Group Holding Ltd said on Friday its voluntary conversion of secondary listing to primary listing on the Hong Kong stock exchange will become effective on Wednesday, a move experts said will attract billions of dollars in investment from the Chinese mainland via the stock connect program linking the Shanghai, Shenzhen and Hong Kong bourses.

Alibaba said in a statement that it will have dual primary listings on both the Hong Kong bourse and the New York Stock Exchange. The voluntary conversion to primary listing in Hong Kong does not involve any issue of new shares and fundraising.

The Hangzhou, Zhejiang province-based company has been listed on the New York Stock Exchange since September 2014, marking what was at the time the largest IPO in history. It raised $13 billion from the Hong Kong bourse via a secondary listing in November 2019. In July 2022, Alibaba applied for a primary listing in Hong Kong.

A primary listing implies the issuer has met strict regulatory and financial reporting criteria of the bourse concerned, which leads to investors perceiving its stock as of high quality because the issuer is regarded as reputable. A secondary listing, which creates access to new capital markets, may have less stringent requirements and lower costs, and gives the issuer greater flexibility.

"The dual primary listing of Alibaba in the Hong Kong and New York bourses will help the company further expand investor base, especially those from the Chinese mainland and other markets in Asia, promote the diversification of its shareholder structure and enhance the liquidity of Alibaba's shares in the Hong Kong bourse," said Jiang Han, a senior researcher at the Beijing-based think tank Pangoal Institution.

Jiang said the move is conducive to optimizing capital structure and improving Alibaba's position in the capital market, rather than simply raising funds, while helping protect the interests of existing shareholders and giving investors more flexibility to own and trade Alibaba's shares.

The conversion to primary listing in Hong Kong is expected to allow Alibaba to be included in the Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect programs, which will let Chinese mainland investors directly invest in Alibaba, bring about more southbound capital flows to the company and provide a strong support for its long-term growth, he said.

Zhu Keli, founding director of the China Institute of New Economy, said the reason behind Alibaba's primary listing in Hong Kong appears to be that "the tech giant aims to mitigate potential risks and reduce uncertainties from, and dependence on, a single market amid an increasingly complex and volatile international environment, as well as broaden its financing channels, in a bid to support its continuous business expansion and investments in tech innovation."

Zhu said the move will bolster Alibaba's market valuation and bring about more strategic cooperation opportunities for the company, adding it will also allow Chinese mainland investors to trade in the tech giant's shares and further improve stock liquidity.

He further said that in recent years, Hong Kong has continued to strengthen its position as an international financial center, optimizing the listing mechanism and regulatory environment to attract many world-renowned companies to go public.

"Alibaba's move in Hong Kong is a recognition of the development potential of Hong Kong's capital market and will also attract the attention of global investors," Zhu said.

The Hong Kong stock exchange has changed its rules to allow innovative Chinese mainland companies with weighted voting rights or variable interest entities to carry out dual-listing in the city.

Chen Duan, director of the Digital Economy Integration Innovation Development Center at the Central University of Finance and Economics, said the new primary listing in Hong Kong will help better protect the interests of investors and inject new liquidity into the Hong Kong bourse.

Ningbo seabird project seeks international volunteers

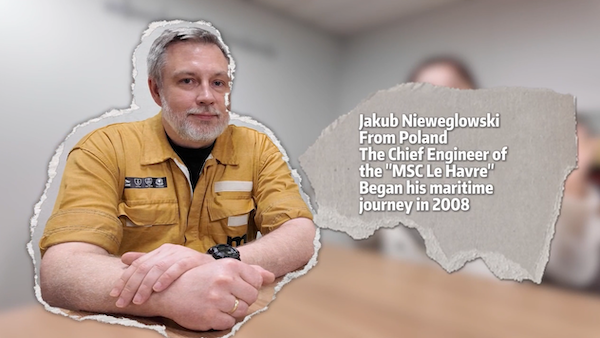

Ningbo seabird project seeks international volunteers  Jakub's journey: From shipyard to sea

Jakub's journey: From shipyard to sea  Badminton Asia COO applauds Ningbo

Badminton Asia COO applauds Ningbo