Increased foreign investment in hospitals set to boost healthcare

New born triplets are successfully delivered at Shanghai Jiahui International Hospital, a hospital owned by Hong Kong investors, on July 12. The premature babies got through infection, respiratory, and nutritional challenges. [Photo provided to China Daily]

Further opening-up of China's medical sector to foreign investment is expected to promote high-quality services and better meet wider public healthcare needs, experts said.

A circular, jointly issued by the Ministry of Commerce, the National Health Commission and the National Medical Products Administration in September, allows wholly foreign-owned hospitals to operate in eight cities, including Beijing and Shanghai, and throughout the island of Hainan.

Decision-makers intend for public hospitals to guarantee the basics, while foreign-owned ones provide diversified services to meet the rising demand for more personalized, higher-standard medical treatment amid the country's ongoing economic and social development, industry experts said.

"Accounting for the dominant 80 percent of the country's total medical services, public hospitals stick to their priority of answering the demands of public welfare," said Liao Xinbo, former deputy director of Guangdong's Health Commission. "The spillover functions of public hospitals that are difficult to support through public medical insurance can be met wholly by foreign-funded medical institutions," Liao added.

These other functions include the use of advanced technologies and innovative therapies, and medical treatment usually done overseas, he said.

The market size of Chinese patients who travel overseas for medical treatment exceeded 3 billion yuan ($420 million) in 2019, and surpassed 4 billion yuan within three years, according to a report released by Insight and Info, a Chinese portal specializing in industry analysis.

Developed countries, such as the United States and Japan, were the main medical travel destinations, the report said.

Double benefits

Wholly foreign-owned enterprises setting up medical institutions in China will not only contribute to further opening-up, but also test whether this model is suitable for the entire country, experts said. Many top international hospitals are different from their counterparts in China in terms of patient care, technology, management models, and service awareness, they added.

"For example, the service model is one area where gaps are seen between Chinese and foreign medical treatment," said Liu Guoen, dean of the Institute for Global Health and Development at Peking University.

"China's public hospitals, especially the tertiary ones in big cities, are often overcrowded and are not in a position to provide patient-centric medical services.

"When different types of hospitals compete on the same stage, it's expected to have a positive impact on the entire medical service ecology in the country," he said.

Although some public hospitals have provided high-end medical services through their international departments, they are still limited due to the backgrounds and management methods of these hospitals, industry observers said.

However, wholly foreign-owned hospitals are not subject to the same restrictions on public medical insurance, and can set prices independently. This allows them to avoid institutional constraints and introduce industry game-changers, they said.

Shanghai Towako Hospital, China's first wholly foreign-owned hospital, opened in the Shanghai Pilot Free Trade Zone in 2016. An unnamed senior hospital executive told local media in a recent interview that they were delighted to see the relaxation of the policy again, which is good news for all medical institutions with foreign funding.

The Japan-funded hospital specializes in assisted reproductive services and was profitable within three years of opening. It has had 300,000 patient visits, and provided medical assistance to nearly 2,300 babies delivered there.

In 2021, there were more than 300 joint-venture medical institutions in the country with foreign investment, National Health Commission data showed. Around 38 percent were hospitals, and the rest were clinics or outpatient departments operating under an asset-light business model.

Policy tweaks

The other five provincial-level regions where foreign entities will be allowed to set up medical institutions are: Tianjin, Nanjing and Suzhou, Jiangsu province, Fuzhou, Fujian province, and Hainan province, according to the new policy jointly released by the Ministry of Commerce, the National Health Commission, and the National Medical Products Administration.

These entities can also apply for market registration and mass production licenses in China for their products, and those that are approved can be used nationwide.

Pilot programs allowing wholly foreign-owned hospitals date back to 2014, when the National Health Commission allowed overseas investors to set up in seven provincial-level regions — including Beijing, Tianjin, and Shanghai — through the establishment of new ventures and mergers.

After that, the policies varied. In 2015, the National Development and Reform Commission and the Ministry of Commerce issued a revised catalog to guide foreign investment in industries that placed medical institutions in the restricted category.

Two years later, the State Council, China's Cabinet, issued a document, which clarified that foreign funds could be invested in domestic medical institutions via joint ventures and cooperation measures. The Government Work Report delivered in March this year proposed that market access for medical services be relaxed, along with other areas.

"We feel that such adjustments in the national policy regarding the country's openness to allow wholly foreign-invested hospitals were affected by top-level design," said Pan Jie, CEO of the Asia-Pacific Medical Group.

The United States' investment firm Bain Capital backs APMG, which funded the Shanghai Xiehua Brain Hospital. The hospital opened in July in the Shanghai New Hongqiao International Medical Center and provides high-quality medical services for patients with central nervous system diseases.

"As organizers of such hospitals, we hope that policies and regulations can be stable and consistent for a long time. Meanwhile, we hope to receive more guidance and practical support at the operational level," said Pan.

Industry insiders believe that more wholly foreign-invested hospitals will help normalize relevant rules and regulations.

While unveiling the new policy in September, authorities called for stepping up services for foreign enterprises willing to participate in trial programs. Government departments were also urged to strengthen coordination and supervision to promptly detect risks.

Experts said both the relaxation and tightening of policies are understandable, as the opening-up of medical care is closely related to people's health and social stability.

"However, I believe the government is more confident and resolute this time, as the need to expand is more than it was a decade ago. The policy will be better implemented than in the past," said Liu.

Better living standards

Wholly foreign-invested hospitals will help accelerate the introduction of new drugs, medical equipment, and technologies into China, industry insiders said. The move will also create a channel for medical talent from overseas to work in the country.

"With a rising number of such hospitals, it will also further improve social and living security for expats in China, thereby helping the country to attract high-level talents from around the globe, enhancing international academic exchanges and promoting the development of various disciplines and scientific research innovation," said John K. Hsiang, chairman of Jiahui Health executive committee.

The company operates the Hong Kong-owned Jiahui International Hospital in Shanghai, which opened in 2017. It also runs outpatient clinics in Shanghai, Suzhou, Hangzhou, Zhejiang province, and Shenzhen, Guangdong.

Fifteen percent of Jiahui's doctors are expats, and the company provides medical services in more than 10 languages. The Shanghai hospital alone has an annual outpatient volume of 600,000 visits, and has provided medical services to over 500,000 families from more than 180 countries.

The differences in expats' medical needs lie not only in languages, but also in factors including diagnosis, the treatment process, and the payment model.

Hsiang said one important service offered at foreign-invested hospitals is connecting patients to medical resources abroad.

"Based on cooperation with more than 30 topnotch medical institutions around the world, including Boston-based Massachusetts General Hospital, Jiahui is able to provide international telemedicine consultations and prioritizes referrals to overseas hospitals for patients," he said.

In 2022, Vicky Lee, an internationally renowned expert in hematology and oncology with more than two decades professional experience in the US, joined Jiahui's international cancer center. Lee quickly introduced cutting-edge therapies to the hospital, which attracted more patients.

Last year, a 40-year-old Singapore woman's lymphoma went into remission after she received CAR-T cell treatment at Jiahui International Hospital. She was the first expat in China to receive the revolutionary lymphoma treatment.

"We once considered returning to the US or Singapore for treatment, but eventually decided that Jiahui Hospital was the best option for us," said Parry Wu, the patient's husband, who is from the US.

"The team and the facilities here are as good as anywhere in the world, and the overall cost effectiveness of the treatment was too good to be ignored."

Lee said the patient has returned to an active life and has embarked on global travel, which included diving. She added that a considerable number of patients with hematological tumors, 80 percent of whom are expats, had completed CAR-T therapy at the hospital.

Jiahui also completed a smooth delivery of triplets in July and performed highly difficult laparoscopic surgery on a pancreatic cancer patient in August.

Shanghai Xiehua Brain Hospital, which has investment of 1.2 billion yuan, boasts state-of-the-art large imaging devices and specialized neurosurgery equipment. It was the first private medical institution in the country to adopt the Shanghai United Imaging Healthcare Group's 5.0T ultrahigh field MRI imaging system.

Winning support

Specific conditions, requirements, and procedures for establishing wholly foreign-invested hospitals will be released later, authorities said.

Meanwhile, more supportive policies to breakdown regional barriers will need to be introduce to allow cutting-edge drugs, devices, and technologies, industry insiders said. Qualified hospitals should also start pilot projects and introduce more new concepts and therapies to China to truly achieve seamless integration with markets worldwide, they added.

Support is also needed to carry out clinical trials and introduce healthcare professionals from overseas.

In 2020, Shanghai Jiahui International Hospital filed a request to conduct drug clinical trials.

"We expect the government to further reduce restrictions on foreign-invested medical institutions in terms of relevant regulatory requirements and policies for clinical trials," said Hsiang. "We also hope that short-term work permits for nurses and medical technicians from overseas can be allowed, and the review process for expat doctors to be recognized and evaluated for professional titles and qualifications will be streamlined," he added.

Including Shanghai Xiehua Brain Hospital, Bain Capital operates 12 hospitals in Beijing, Shanghai, and the Yangtze River Delta region through APMG.

"But being foreign-invested hospitals doesn't necessarily mean we are expensive. Hospitals in our group target serving ordinary people in China," said Pan, CEO of APMG, adding that the hospitals have formed a group specializing in neurology, oncology, and rehabilitation.

"Take Xiehua, which is located in Shanghai's Hongqiao area, as an example. It is dedicated to providing patients from the delta region with accessible, affordable, and differentiated high-quality medical services," he said.

Ningbo seabird project seeks international volunteers

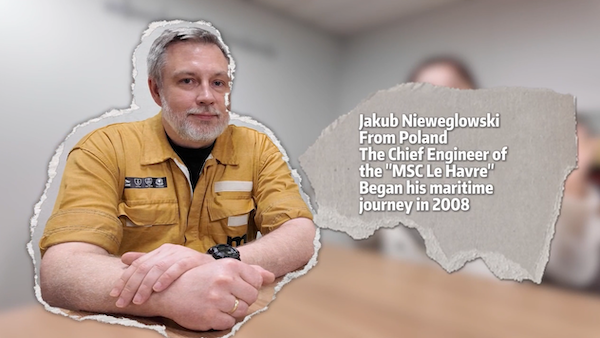

Ningbo seabird project seeks international volunteers  Jakub's journey: From shipyard to sea

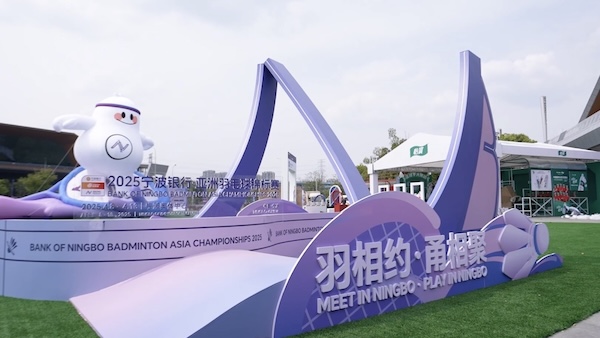

Jakub's journey: From shipyard to sea  Badminton Asia COO applauds Ningbo

Badminton Asia COO applauds Ningbo