Preferential policies

Income tax for enterprises with foreign investment and foreign enterprises

It is prescribed by the State that the income tax on enterprises with foreign investment shall be computed on taxable income at the rate of 30%.

The income tax on the productive enterprise with foreign investment of a productive nature established in Ningbo proper and the areas within its jurisdiction shall be levied at the reduced rate of 24%.

The income tax on enterprises with foreign investment in Ningbo Economic and Technical Development Zone, Daxie Island Development Zone, Ningbo Free Trade Zone, andNingbo High-tech Industry Park, projects within the scope of energy, communications, harbor, wharf, or other projects encouraged by the State, projects with foreign investment exceeding $30 million and with long period of investment recovery, shall be levied at the reduced rate of 15%, among which those with an operational period of more than 10 years shall be exempted from income tax within the first two profit-making years, and allowed a half reduction of income tax from the third to the fifth year.

Foreign-funded enterprises engaged in agriculture, forestry, animal husbandry may, upon approval by the competent department for tax affairs under the State Council of an application filed by the enterprises, be allowed a fifteen to thirty percent reduction of the amount of tax-payable income for a period of another ten years on the expiry for tax exemption and reduction as provided in the preceding paragraphs.

In the years following the expiration of the period for tax exemption or reduction, the export enterprises with annual value of export products covering 70% or more of the annual value of the total products shall be levied at the reduced rate of 12%. (The enterprises in Ningbo Economic and Technical Development Zone, Daxie Island Development Zone, Ningbo Free Trade Zone and Ningbo High-tech Industry Park will be levied at the reduced rate of 10%).

Technologically advanced enterprises shall be levied at the reduced income rate of 12% for an extension of 3 years following the expiration of the period for tax exemption or reduction. (The enterprises in Ningbo Economic and Technical Development Zone, Daxie Island Development Zone and Ningbo Free Trade Zone and Ningbo High-tech Industry Park shall be levied at the reduced rate of 10% for an extension of 3 years).

Re-investment tax reimbursement

Any foreign investor of an enterprise with foreign investment who reinvests its share of profits obtained from the enterprise directly into that enterprise by increasing its registered capital, or who uses the profit as capital investment to establish other enterprises with foreign investment to operate for a period of no less than 5 years shall, upon approval by the tax authorities of an application filed by the investor, be refunded 40% of the reinvested amount of the income tax that has already been paid. Those who reinvest in the export enterprises or technologically advanced enterprises may obtain a refund of all the reinvested amount of the income tax that has been already paid.

Withholding income tax

Any foreign enterprise that has no establishment or place in China but derives profits, interest, rent, royalties or other income from sources in Ningbo, shall be levied at the reduced rate of 10% (except for exemption of the income tax prescribed by law). And those provide advanced technology, or the terms of capital or equipment are preferential, exemption or reduction shall be allowed upon approval.

Income tax concerning remittance

The income tax shall be exempted for the amount of profits gained by the foreign investors from the enterprises in Ningbo when they are remitted out of China.

Customs duties

The customs duties and import-related value-added tax shall be exempted on the equipment for self-use (except for those stipulated in "Catalogue of Imported Commodities not Entitled for Tariff Exemption for Projects with foreign Investment") imported by foreign investment project in accordance with "the Encouraged Foreign Investment Industries and Restricted Foreign Investment Industries (B) of the Catalogue for the Guidance of Foreign Investment Industries (promulgated on 1, April, 2002)".

This English version is only for reference. To learn more, please refer to the authoritative Chinese version.

Ningbo seabird project seeks international volunteers

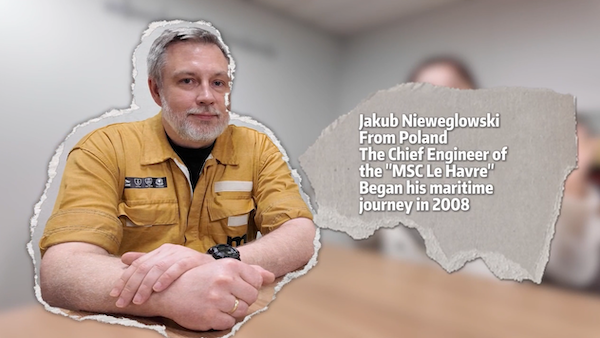

Ningbo seabird project seeks international volunteers  Jakub's journey: From shipyard to sea

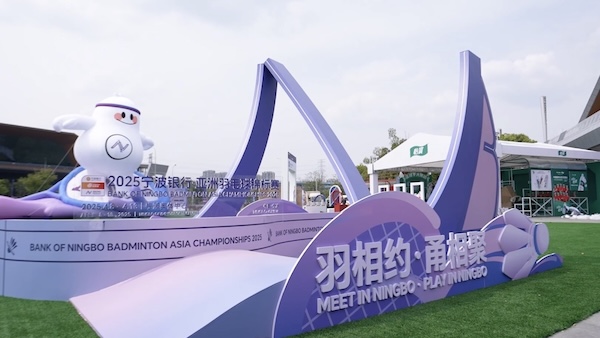

Jakub's journey: From shipyard to sea  Badminton Asia COO applauds Ningbo

Badminton Asia COO applauds Ningbo