Bilibili makes bid to break into online payments

Competition in China's digital payment market is set to intensify as Bilibili, a popular online videosharing and entertainment platform, has obtained a payment license after acquiring a majority stake in an online payment company, industry experts said on Tuesday.

They said a string of internet companies has invested heavily in online payment business to cut dependence on third-party payment operators and reduce operating costs.

Bilibili acquired a 65.5 percent stake in Zhejiang Yongyi Payment Co Ltd for 118 million yuan ($18.5 million) from the online payment company's State-owned shareholders, according to an announcement posted on the website of Ningbo Public Resources Trading Center.

The Shanghai-based company has been recruiting payment business positions on its website since November last year and registered payment-related domain names in January.

As livestreaming e-commerce has been gaining traction in China since the outbreak of COVID-19, short video platforms have accelerated efforts to acquire online payment licenses and roll out self-owned e-payment services, as part of a broader drive to build closed-loop e-commerce businesses.

In January, ByteDance launched its own third-party payment service for its short video platform Douyin, after the Beijing-based tech giant acquired Wuhan Hezhong Yibao Technology Co Ltd in 2020. Moreover, Douyin's rival Kuaishou acquired online payment firm Easylink Payment Co Ltd last year.

Wang Pengbo, a senior analyst from market consultancy Botong Analysys, said the primary reason why internet companies obtain payment licenses is to comply with regulatory requirements. "Financial regulators have required companies engaged in financial business to hold related licenses, which will protect sensitive information such as user data and business data."

Wang said obtaining payment licenses will help companies reduce expenditures on commission fees that are given to other online payment providers, explore other financial value-added services as well as bolster their digital transformation.

Wang added that Bilibili's acquisition will not have a significant impact on the online payment industry in the short term, as it takes time to change users' payment habits and adapt to new payment functions.

The number of online payment service users in China had reached 872 million by the end of June, accounting for 86.3 percent of the country's total netizens, according to a report released by the China Internet Network Information Center.

In recent years, a batch of Chinese tech companies, including Meituan, Pinduoduo, Huawei and Didi Chuxing, have obtained licenses to tap into the payment segment.

However, China's third-party mobile payment sector is dominated by Alipay and WeChat Pay, with the former taking 55.6 percent of the total market in the second quarter last year, according to market research firm iResearch. Other players include JD Pay and Baidu Wallet.

Bilibili has a large number of young active users and diversified businesses, which provide favorable conditions for the video-sharing platform to further expand its consumer finance business, said Su Xiaorui, an analyst from Beijing-based consultancy Analysys.

Obtaining online payment licenses is a prerequisite for short-video platforms to expand into other financial businesses, Su said.

Ningbo seabird project seeks international volunteers

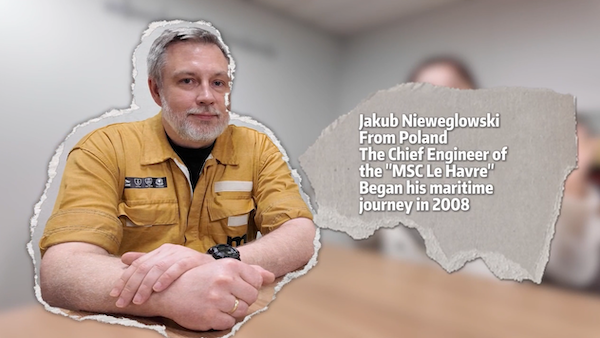

Ningbo seabird project seeks international volunteers  Jakub's journey: From shipyard to sea

Jakub's journey: From shipyard to sea  Badminton Asia COO applauds Ningbo

Badminton Asia COO applauds Ningbo