Ningbo-based EV maker debuts on NYSE

Zeekr, a premium electric vehicle (EV) subsidiary of the Chinese automotive conglomerate Geely, makes its debut on the New York Stock Exchange on May 10. [Photo/Ningbo Daily]

Zeekr, a premium EV subsidiary of the Chinese automotive conglomerate Geely, made its debut on the New York Stock Exchange on May 10.

The company set its initial public offering price at $21 per share, successfully raising a total of $441 million. It is the first manufacturer of complete vehicles and the first new energy vehicle enterprise headquartered in Ningbo, Zhejiang province to be listed.

As per the details outlined in the prospectus, Zeekr's revenue soared from around 6.53 billion yuan ($903.58 million) in 2021 to approximately 31.9 billion yuan in 2022 and 51.7 billion yuan in 2023. Notably, the company's gross profit margin for complete vehicles reached 15 percent in 2023, a significant increase from 1.8 percent in 2021 and 4.7 percent in 2022.

Among pure electric vehicle manufacturers, Zeekr's gross profit margin now ranks just below Tesla, surpassing competitors like NIO and XPeng. The company's sales performance also reflects its upward trajectory, with units sold rising from 6,000 in 2021 to 72,000 in 2022 and 118,000 in 2023. Impressively, the EV manufacturer delivered a total of 49,000 new vehicles in the first four months of this year, marking a growth of over 110 percent year-on-year.

Dai Yong, deputy CFO of Geely Auto Group, expressed confidence that with the increasing sales volume and improved gross profit, Zeekr will stop operating at a loss this year. In 2023, Zeekr reported a loss of about 1.14 billion yuan, an improvement from the roughly 2.04 billion yuan loss in 2022, based on Hong Kong accounting standards.

Looking ahead, Zeekr has set an ambitious sales target of 230,000 units for the current year, which would be twice as many as last year.

The company attributes this projected growth to several key factors: the expanding market penetration of new energy vehicles in China, the diversification of its product portfolio from sedans to SUVs and minivans, an expansion of its domestic store network from primarily first and second-tier cities to third and fourth-tier cities, and the establishment of operations in new international markets such as Sweden and the Netherlands.

Ningbo seabird project seeks international volunteers

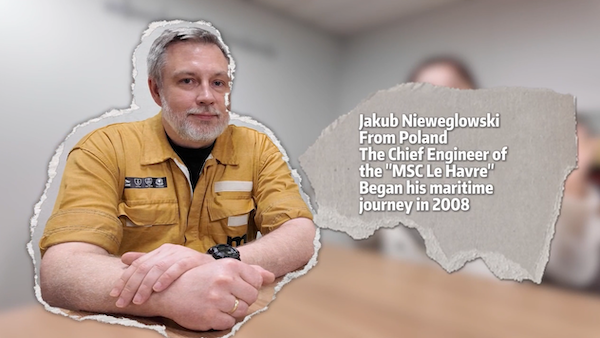

Ningbo seabird project seeks international volunteers  Jakub's journey: From shipyard to sea

Jakub's journey: From shipyard to sea  Badminton Asia COO applauds Ningbo

Badminton Asia COO applauds Ningbo